Hours of Work

Bigfoot observes three hundred twelve (312) workdays in a calendar year, equivalent to forty-four (44) hours per week on a compressed 5-day workweek.

Implementing Guidelines

Implementing Guidelines

- Employees observing a six-day semi-flexible work schedule must log in for work at any time within 8:00 to 10:00 o'clock in the morning, wherein employees are to render eight (8) hours of work per day from Monday to Saturday, excluding lunch break periods of one (1) hour each per day.

- Employees observing a compressed five-day semi-flexible work schedule must log in for work at any time within 8:00 to 10:00 o'clock in the morning, wherein employees are to render nine (9) hours of work per day from Monday to Thursday and eight (8) hours of work on Friday, excluding lunch break periods of one (1) hour each per day.

E.g. An employee observing a compressed workweek schedule and logs in at 8:35 AM may log out at 6:35 PM, if the day falls between Monday- Thursday; and may log out at 5:35 PM if the day is a Friday.

- For shifting employees or those assigned a fixed schedule, the official working schedule is based on the working conditions set forth in the agreement between the employee and management. Semi-flexible time schedule does not apply and employees must log in on or before the start of one's working schedule.

- Pay for Saturday work of individuals observing the six (6) day work schedule is computed as regular pay on the first four (4) hours and overtime pay on the succeeding four (4) hours of work, excluding the one-hour lunch break period.

- Employees who will be absent from work due to vacation, sickness, and/or emergency must file for a leave of absence duly approved by the department head.

Observing three hundred twelve (312) workdays in a calendar year, Saturdays are already considered paid. With the observance of the compressed workweek schedule, only four (4) hours out of the eight (8) hours of regular work on Saturdays have been distributed throughout the week resulting to a nine-hour workday from Monday to Thursday and eight-hour workday on Friday. In the event when a holiday falls on a Saturday, employees who are observing a compressed work schedule are to render only forty (40) hours of work the whole week equivalent to eight (8) hours of work per day (excluding lunch break) prior the holiday-turned-Saturday.

Tardiness and Undertime

Logging in after the expected login time without any approved request for undertime is not allowed; and logging out before the expected logout time without any approved request for undertime is not allowed.

Implementing Guidelines

Implementing Guidelines

- Employees who log in eleven (11) minutes but not more than sixty (60) minutes after the expected starting time for work are considered tardy.

- Employees who log in more than one (1) hour after the expected starting time for work are considered to have committed unauthorized undertime.

- Employees who log out at least one (1) minute before the expected logout time are considered to have committed unauthorized undertime.

- Employees may file for authorized undertime of at least one (1) hour after the expected login time by filling out a Leave/Undertime Form. Application for authorized undertime must be filed at least one (1) working day before the covered date of undertime and must be submitted to the HR office duly approved by the department head. In cases where employee decides to render undertime due to sickness, emergency or personal matter that needs immediate attention, the employee is advised to inform his/her immediate superior and HR not later than 10:00 in the morning, and filing can be done immediately on the same date upon reporting for work.

- Employees may also file for authorized undertime of at least one (1) hour before the expected logout time by filling out a Leave/Undertime Form. Application for authorized undertime must be filed the latest on the same date before availing the undertime.

- If an employee has existing paid leave credits, authorized undertime can be covered under sick/vacation/emergency leave, depending on the reason for undertime.

- The accumulated number of minutes incurred for tardiness and/or unauthorized undertime within a certain payroll period is subject to deductions from the employee's payroll account on a per minute computation, without prejudice to whatever liabilities that the employee may have committed under the Company policies, rules and regulations and/or the Labor Code of the Philippines, as amended.

- Employees considered tardy or undertime will not be entitled to claim for overtime pay and meal allowance.

- The Company reserves the right to deny the employee's application for undertime.

Overtime

Employees may render authorized overtime work if work does not get accomplished beyond the regular working hours of a day. In the case of a compressed workweek schedule, the regular working hours refers to the compressed hours in a day and work rendered thereafter is considered as overtime work.

The company may also declare an "EMERGENCY OVERTIME WORK", as provided for under the Labor Code of the Philippines, as amended, under any of the following cases, to wit:

The company may also declare an "EMERGENCY OVERTIME WORK", as provided for under the Labor Code of the Philippines, as amended, under any of the following cases, to wit:

- When the country is at war or when any other national or local emergency has been declared by Congress of the Philippines or the President.

- When it is necessary to prevent loss of life or property or in case of imminent danger to public safety due to an actual or impending emergency in the locality caused by serious accidents, fire, flood, typhoon, earthquake, epidemic, or other disaster or calamity.

- When there is urgent work to be performed on machines, installations, or equipment, in order to avoid serious loss or damage to the employer or some other cause of similar nature.

- When the work is necessary to prevent loss or damage to perishable goods.

- Where the completion or continuation of the work started before the eight hour is necessary to prevent serious obstruction or prejudice to the business or operations of the company.

- Rendered work shall be considered for overtime pay if it has reached to one (1) hour or more after the employees' normal working hours of the day.

- Entitled employees should file for overtime request by filling out the Overtime Form (Group/Daily) or Overtime Form (Individual/Weekly) which reflects the reason for overtime, projected overtime period, signature of the employee, and approval of the immediate superior or department head.

- Overtime Form (Group/Daily) is filed on a daily basis for one or more employees belonging to the same department and must be submitted to the HR office not later than 5:00 pm of the covered date for overtime work.

- Overtime Form (Individual/Weekly) is for an employee with projected overtime period for a given week. The filled-out form must be submitted to the HR office not later than 5:00 pm of the start date for overtime work.

- An employee who renders actual overtime work beyond the projected overtime period reflected in the Overtime Form must secure on the following working day the submitted form from the HR office, indicate the actual period for overtime work, have the immediate superior or department head approve the form based on the actual overtime work, and submit the form back to the HR office on or before 5:00 pm. Late submission of overtime forms due to valid reasons are still accepted not later than 5:00 pm of the cut-off date for the payroll period.

- For employees in shift schedules, a copy of the approved projected overtime period must be forwarded to the HR Department at least three (3) hours before the end of regular shift. A copy of the approved Overtime Form shall be submitted to the HR Department not more than twenty-four (24) hours after the actual overtime period.

- Employees who render official overtime work and logout between 11:00 PM to 2:00 AM may report for work no more than twelve (12) hours after the logout time; and, those who logout beyond 2:00 AM may report for work not later than 2:00 PM of the same working day without being considered as tardy. Further, employees who render official overtime work and logout from 11 PM or beyond may logout at 8:00 PM on the following schedule of reporting for work and hours rendered shall be considered as one (1) working day. This does not apply if the following working day/schedule is a rest day or holiday.

- Generally, overtime work of those employees who have incurred tardiness on the same day shall not be considered for overtime pay and/or meal allowance. Upon immediate superior's approval, tardy employees who render overtime work shall be given an emergency allowance of one hundred pesos (Php 100.00).

- Employees must file for work rendered on a non-working day by filling out the Overtime Form to be approved by the immediate superior or department head. Work rendered by an employee during a day off should not be less than four (4) hours nor more than eight (8) hours.

| OT TIME OUT | TIME IN (Next Reporting Schedule) | TIME OUT | REMARKS |

| 11:40 PM | 11:40 AM | 8:00 PM | Work equivalent to one (1) working day |

| 2:00 PM | 2:00 PM | 8:00 PM | |

| 2:01 onwards | 2:00 PM | 8:00 PM |

Rest Periods

Employees are entitled to rest periods in accordance with labor law

wherein there must be one (1) rest day a week after six (6) consecutive

workdays. This is identified as Sunday for non-shifting employees. This

is equivalent to fifty-one (51) unpaid days out of the three hundred

sixty-five (365) days.

Break Periods

Bigfoot observes break periods at the discretion of its employees. To relieve oneself of stress, physical discomfort due to prolonged work position, or to satisfy one's gastronomic needs, employees are provided sufficient time to address these needs during break times.

Implementing Guidelines

Implementing Guidelines

- Employees can avail of one (1) hour unpaid lunch break and fifteen (15) minutes each of paid morning and afternoon breaks on every working day.

- Lunch break can be availed at any time within 12:00H to 14:00H. Likewise the morning and afternoon breaks, which are good for fifteen (15) minutes per break, can be availed before 11:00H for morning break, and after 14:00H PM for afternoon break.

- For employees observing a shifting schedule, their meal periods can be availed at a schedule mutually agreed upon between the employee and immediate superior.

- No one is allowed to exceed the time limit for breaks. Also no one is allowed to take one's break before or beyond the respective break times unless with the permission of the immediate superior or department head.

Biometric Logs Policy (for non-employees) [View PDF]

Methods of Payment (for Non-Philippine entity staff)

The following methods of payment are needed of non-Philippine entity staff:

- U.S. bank account with Bigfoot able to mail checks to a U.S. Address

- Hong Kong bank account for HK people who have work visa in HK or for people who do not work there.

- European Bank Account with IBAN in Euro (not: GBP or CHF)

Pay Practices

Salary Administration (General Labor Standards)

Salary Observing six (6) workdays per week, employee monthly rate does not include payment for rest days (Sunday) but includes payment for ten (10) regular holidays and two (2) special days. With three hundred fourteen (314) workdays in a calendar year, Equivalent Daily Rate (EDR) shall be computed as follows:

Basic Monthly Rate X 12 = Equivalent Daily Rate

314 Where:

302 = number of ordinary working days

10 = number of regular holidays

2 = number of special holidays

Employee will not be deducted for not working on these twelve (12) regular and special holidays.

An employee who works on any regular holiday, but not exceeding eight (8) hours, shall be paid two hundred (200%) percent of the employee's daily wage. If the holiday falls on a rest day, an employee who works on any regular holiday is entitled to an additional premium pay of at least thirty (30%) percent of the regular holiday pay of two hundred (200%) percent based on the employee's regular wage rate.

On the other hand, if employee performs work in excess of 8 hours on a regular holiday, employee shall be paid an additional 30%. The regular rest day rate of an employee shall consist of 200% of the employee's regular rate plus 30%.

Overtime Work

Overtime work is work performed beyond eight (8) hours a day or according to the number of hours mutually agreed between employer and employee as the regular hours a day.

Computing Overtime:

On Ordinary Days

Number of hours in excess of 8 hours (125% x hourly rate)

On a rest day, special day or regular holiday

Number of hours in excess of 8 hours (130% x hourly rate)

Night Shift Differential

An additional compensation of ten percent (10%) of an employee's regular wage shall be provided for each hour of work performed between 10:00PM and 6:00AM.

Computing Night Shift Premium Where Night Shift is a Regular Work:

On Ordinary day (110% x basic hourly rate)

On a rest day, special day, regular holiday (110% of regular hourly rate for a rest day, special day, regular holiday)

Computing Overtime on Night Shift:

On ordinary day (110%) x overtime hourly rate)

On rest day, special day or regular holiday (110% x overtime hourly rate for rest days, special days, regular holidays)

Premium Pay

An additional compensation shall be provided for work performed within eight (8) hours on non-working days, such as rest days and special days.

Rest Days and Holidays

Rest Day refers to any rest period of not less than twenty-four (24) consecutive hours after not more than six (6) consecutive work days. Holidays or Special Days refer to days classified as such by law or declared by competent public authority, whether or not it falls on an employee's work day or rest day. - Regular Holidays

An employee is entitled to one's daily basic wage for any unworked regular holiday, provided concerned employee is present or is on leave of absence with pay on the work day immediately preceding the holiday.

- Special Holidays

During special days, the principle of "no work, no pay" applies and on such other special days as may be proclaimed by the President or by the Congress.

Computing pay for work done on:

A special day (130% x basic pay)

A special day, which is also a scheduled rest day (150% x basic pay)

A regular holiday (200% x basic pay)

A regular holiday, which is also a scheduled rest day (260% x basic pay)

13th Month Pay

All employers are required to pay their rank and file employees a thirteenth (13th) month pay, regardless of the nature of their employment and irrespective of the method by which their wages are paid provided they worked for at least one (1) month during a calendar year. Thirteenth (13th) month pay should be given to the employees not later than December 24 of every year. (See Computation of 13th Month Pay)

Computing 13th Month Pay:

Total basic salary earned for the year, exclusive of overtime premium, holiday pay, and night shift differential pay divided by 12 = 13th month pay.

Pay Procedures

Bigfoot observes electronic payment of salaries and enrolls the employee under an ATM payroll account. In the interim during processing of employee's ATM card, the Company may disburse the employee's pay in cash or check.

Bigfoot observes two payroll periods and pay dates - from the 24th of the month to the 8th of the next month accordingly released on the 15th; and on the 9th to 23rd of the month accordingly released on the 30th or last day of the same month. In the event that a payday falls on a holiday or a rest day, payday shall be scheduled on the next working day.

Timekeeping starts every cutoff period. During cutoff, printouts of each employee's daily attendance (login/logout) record are given to the relevant employees for review. These printouts are to be collected the following working day or immediately after employees have accepted and signed HR's copy of the printout. Valid changes in the attendance data are adjusted accordingly.

All government-mandated deductions and Company accountabilities (e.g. salary deduction schemes) are reflected on the pay slip.

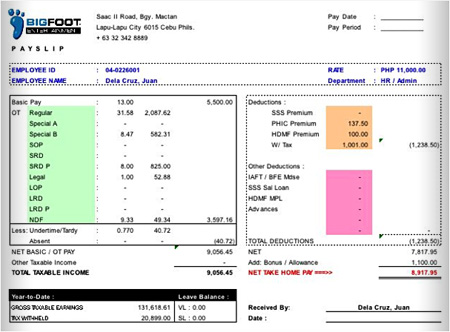

Pay Slip Format

Legend:

Basic pay - Basic pay/number of days worked

Regular - Regular Overtime

Special A - Special Overtime on weekdays

Special B - Special Overtime on rest day

SOP - Special Overtime Premium (excess of 8 hours)

SRD - Special Rest Day (special holiday falls on a day-off)

SRD P - Special Rest Day Premium (excess of 8 hours)

Legal - Overtime on Legal Holiday

LOP - Legal Overtime Premium (excess of 8 hours)

LRD - Legal Rest Day (regular holiday falls on day-off)

LRD P - Legal Rest Day Premium (excess of 8 hours)

NDF - Night Differential

Salary Adjustment

Depending on the financial capability of Bigfoot, salaries may be adjusted based on the annual performance review and/or the inflationary rate determined by the National Economic Development Authority (NEDA). Group Incentive Plans and Bonuses

Aside from the 13th month pay, Bigfoot may award its employees bonuses or performance incentives, as approved by the Chief.Business Expenses [View PDF]

Statutory Benefits

Social Security

Social security provides replacement income for workers and its beneficiaries in times of death, disability, sickness, child birth or miscarriage, and old age. The Social Security System (SSS) administers social security protection to workers in the private sector.

Monthly contributions are on average about 8.4% of monthly compensation if the worker is not earning over Php14,000.00, and slightly less if the worker is earning more. Roughly, the employer shoulders about 5.1%, and the employee 3.3%.

Hereunder are the benefits that are available for covered employees:

Sickness Benefit - A daily cash allowance (90% of the average salary credit) paid for the number of days a member is unable to work due to sickness or injury. A member can avail of this benefit if he/she is unable to work due to sickness or injury or is confined either in a hospital or at home for at least four (4) days, provided that the employee has paid at least three (3) months worth of contributions within the 12- month period immediately before the semester of sickness

- A member can be granted sickness benefit for a maximum of one hundred twenty (120) days in a calendar year

- It shall not be paid for more than two hundred forty (240) days on account of the same illness; it shall be considered for disability claim

Maternity Benefit - A daily cash allowance (100% of the average daily salary credit) granted to a female member who was unable to work due to childbirth or miscarriage; sixty (60) days for normal delivery or miscarriage and 78 days for caesarian section delivery

- Member must have paid at least three (3) monthly contributions within the twelve- month period immediately preceding the semester of her childbirth or miscarriage provided that she has given the required notification of her pregnancy through her employer

- It shall be paid only for the first 4 deliveries or miscarriages

Disability Benefit - This benefit is given to a member who becomes permanently disabled, either partially or totally, and can be paid either in monthly pension or lump sum

- A member who suffers partial or total permanent disability is qualified as a disability beneficiary if he has paid at least one monthly contribution to the SSS prior to the semester of his/her contingency

- Monthly Pension

- Refers to the cash benefit paid to a disabled member who has paid at least thirty-six (36) monthly contributions to the SSS prior to the semester of disability

- Lump Sum

- Amount is granted to those who have not paid the required thirty- six (36) monthly contributions

Retirement Benefit - A cash-in monthly pension or lump sum paid to members who can no longer work due to old age, available to a member who optionally retires at sixty (60) or to a member who is sixty (60) years old or over.

- Monthly Pension

- Lifetime cash benefit (until member dies) to the retiree who has paid at least one hundred twenty (120) monthly contributions

- Lump Sum

- Paid to those who have not paid the required one hundred twenty (120) monthly contributions

Death Benefit - A cash benefit in monthly pension or lump sum paid to the beneficiaries of a deceased member

Employee Compensation (EC) Program - Aims to assist workers who suffer work-connected sickness or injury resulting in disability or death

- Benefits under the EC program may be enjoyed simultaneously with benefits under the social security program

PhilHealth

The Philippine Health Insurance Corporation, or PhilHealth, is a government-owned corporation given the task to administer a sustainable program that will not only provide better health care services at an affordable cost, but also cover a broader membership base that will lead to universal coverage. The individual contribution depends on the salary range of the employee. - Benefits cover both hospitalization and outpatient care

- Hospitalization benefits can only be availed in PhilHealth accredited hospitals

- Member must have paid at least three (3) monthly contributions within the immediate 6 months period before the month of confinement

- PhilHealth assistance only covers the forty-five-day confinement allowed per year

PAG-IBIG Fund

PAG-IBIG is a compulsory deduction during payroll that offers loan programs.

An employee earning more than Php1,500 per month needs to contribute two (2%) percent of one's monthly salary. Likewise, the Company also provides a two (2%) percent counterpart every month. The maximum counterpart that an employee or employer is mandated to give is for a declared income of Php5,000 per month. However, employee can opt to declare more and pay more. - Housing Loan Program

- Multi-Purpose Loan

- Provident Savings Fund

Company Initiated Benefits

Meal Allowance

The Company provides employees with meal subsidy for rendered overtime work under specified time periods.

Implementing Guidelines

- All employees regardless of rank are given a meal allowance of one hundred pesos (Php 100.00) each provided that they have rendered overtime work for at least two (2) hours; and an additional one hundred and fifty pesos (Php 150) if rendered overtime work reaches six (6) hours.

- Generally, overtime work of those employees who have incurred tardiness on the same day are not entitled to meal allowance.

- In filing for request for meal allowance, employees are to fill-out the Overtime/Meal Allowance Form and submit the filled-out form to the HR Department not later than 5:00 PM of the covered date for overtime work.

- On the following day/schedule of reporting for work, the concerned

employees who have requested for meal allowance are to secure the

submitted Overtime/Meal Allowance Form from the HR Department for the

immediate supervisor's approval and give the form back to HR Department.

Transportation Allowance

The Company provides employees with a fixed monthly transportation allowance, and transportation subsidy from workplace to residence in the event of overtime work rendered until or after ten o'clock in the evening where options for transportation are limited.

Implementing Guidelines - Those hired or issued job offer as employees as of March 03, 2010 and onwards, shall no longer be offered a transportation allowance. However, incumbent (employees hired up to March 02, 2010) employees shall continue to be given an allowance of one thousand pesos (Php 1,000.00) for those belonging to job levels receiving basic monthly salaries below twenty thousand pesos (Php 20,000.00), and five hundred pesos (Php 500.00) for those receiving above Php 20,000.00.

- All employees regardless of rank who render official overtime work and logout on or after 10 o'clock in the evening shall be given taxicab fare subsidy of One hundred pesos (Php 100.00).

- Generally, employees who have incurred tardiness on the same day shall not be entitled to taxicab fare subsidy as they are not entitled to overtime pay (as applicable) and meal allowance.

- In filing for request for transportation fare subsidy, employees are to fill out the Overtime/Undertime/ Allowance Form duly approved by the department head concerned.

Vacation Leave

The Company provides regular employees with ten (10) days paid leave credits for workdays scheduled by employees to relieve oneself from the demands of work and spend quality time with oneself or others.

Upon employee's date of regularization, employee is granted a pro-rated number of vacation leave credits based on the month that an employee is regularized, as further shown in the table below:

MONTH OF REGULARIZATION

NO. OF LEAVE CREDITS

January

10 days

February

9.13 days

March

8.3 days

April

7.47 days

May

6.64 days

June

5.81 days

July

4.98 days

August

4.15 days

September

3.32 days

October

2.49 days

November

1.66 days

December

0.83 day

Implementing Guidelines

- Regular employees earn leave credits on a monthly basis based on the table below:

MONTH

LEAVE CREDITS

January

0.83 day

February

1.66 days

March

2.49 days

April

3.32 days

May

4.15 days

June

4.98 days

July

5.81 days

August

6.64 days

September

7.47 days

October

8.30 days

November

9.13 days

December

10.00 days

- Advance credits shall be allowed, such that at the beginning of the year, employees may use or avail of the full credit of ten (10) days vacation leave (and/or sick leave as the case may be) even though these are yet to be earned.

- However, in case of resignation or separation from the company, any difference from the number of leaves used or availed as against actual credits earned at the time of resignation or separation shall be recouped or deducted from the employee's final pay.

For example:

Employee X avails of five (5) vacation leave days in April 2009 then tenders resignation or is separated from the service on the same month. Based on the leave credits table, the employee's actual vacation leave credit for April is only 3.32 days. The difference of 1.68 days shall then be deducted from the employee's final pay.

- The same principle of proration (or pro-rate basis) shall apply in computing sick leave credits, which are convertible to cash when unused, in the event of resignation or separation from the company.

- No vacation leave shall be availed of unless the employee has filed for a leave of absence duly approved by the immediate superior. All approved vacation leaves should be submitted in hard copy at least one (1) week prior to the actual leave of absence to the HR Department. Employees who failed to file for a leave of absence shall be considered Absent Without Official Leave (AWOL) and will not be paid for his/her absence, without prejudice to whatever disciplinary action that may be taken against him/her in accordance with the company policies, rules and regulations and the Labor Code of the Philippines, as amended.

- An employee who goes on vacation leave is expected to report back to work on the following working day of the approved leave. If in case the employee cannot report back to work on the specified date, he is required to inform the HR Department/immediate superior at least on the first hour of the extended vacation leave. Upon return, he/she is required to file for a leave of absence for his extended Vacation Leave approved by his immediate superior to the Human Resource office. Failure to do so without notifying his immediate superior/HR shall be subjected to disciplinary action and will be considered absent.

- Leaves start at one (1) day and minutes thereafter. However, authorized undertime due to vacation may be credited to one's existing leave balance.

- Unused vacation leave credits are not convertible to cash, and are non-cumulative to the next set of vacation leave credits for the next calendar year.

- Employees with no remaining credits for vacation leave can still file for vacation leave but shall be treated as unpaid leave.

- Management reserves the right to disapprove vacation leaves and to recall any employee on leave, considering the critical operation needs of the Company.

Sick Leave

The Company provides regular employees with ten (10) days paid leave credits for workdays wherein reporting for work is impossible due to illness.

Implementing Guidelines - The Company grants ten (10) days sick leave with pay to regular employees upon start of every calendar year. Upon employee's date of regularization, employee is granted a pro-rated number of sick leave credits based on the month that an employee has been regularized, as further shown in the table below:

MONTH OF REGULARIZATION NO. OF LEAVE CREDITS January 10 days February 9.13 days March 8.3 days April 7.47 days May 6.64 days June 5.81 days July 4.98 days August 4.15 days September 3.32 days October 2.49 days November 1.66 days December 0.83 day

- If employee cannot report for work due to an unexpected illness, the employee is required to inform his/her (immediate) superior along with the HR Department at the first hour of that day by phone or sending relatives/friends who can personally report the reason for the absence. On the first hour for every day that an employee is absent, employee still has to inform his/her immediate superior or the HR Department except if the range of the sick leave has been specified, (i.e., doctor's recommendation). Upon reporting for work, the employee has to file an application for sick leave approved by the immediate superior to the HR Department. No sick leave shall be paid unless the employee has filed for a leave of absence. All sick leaves should be filed the day the employee returns back to work.

- In appropriate circumstances, the Company may require the employee to be examined by a Company-designated physician, at Company's expense.

- Whenever possible, and subject to the employee's health care provider's approval, absences for planned medical treatment should be scheduled in advance so as not to unduly disrupt Company operations.

- Employees shall be required to give at least one (1) week advance notice in the event of a foreseeable medical treatment. To assist in arranging the work assignments during employee's absence, employee must give prior notice as well as an indication, to the extent known, of the expected return date.

- In the event that an employee has been absent from work for three (3) consecutive days, the employee is required to present a medical certification that he/she was sick for the period and that he/she is already physically and mentally fit to return to work (a "fitness-for-duty" report) to the Human Resource office. Where such a certification is required, the employee will bear the cost of the certification and is not entitled to be paid for the time or travel costs spent in acquiring the certification.

- Leaves begin at one (1) day and minutes thereafter. However, authorized undertime due to sickness may be credited to one's existing leave balance.

- Unused sick leave credits at the end of the calendar year are convertible to cash and will be credited to the employee's account on the first payroll after the start of the next calendar year.

- Employees with no remaining credits for sick leave can still file for sick leave but shall be treated as unpaid leave.

- Management reserves the right to disapprove any sick leave, if in its opinion, the employee is not really sick and the operations of the Company will be unduly jeopardized. However, if the Company designated physician declares that the employee is actually sick and needs rest, management will grant the sick leave.

Emergency Leave

Bigfoot provides employees with paid leave credits to supplement consumed vacation or sick leave credits during emergency situations wherein the employee's immediate attention is required.

Implementing Guidelines

- All regular employees are given three (3) Emergency Leave credits, in addition to the employee's vacation and sick leave credits, which is not cumulative and not convertible to cash.

- An "emergency" is defined as an unexpected circumstance, such as fire, earthquake, typhoon, landslides, death or serious illness of an immediate family member, and/or any other extenuating circumstances that affects the employee and his family and causes the employee to be absent from work.

- The emergency leave must be filed on the day that the employee has returned to report for work duly approved by the department superior and the HR Department. Otherwise, it shall be considered as leave without pay.

- Leaves start at one (1) day and minutes thereafter. However, authorized undertime due to emergency may be credited to one's existing leave balance.

An "immediate family member" is defined as a parent, parent-in-law, spouse, children, or sibling.

Special Leaves

Bigfoot provides ample time for employees to attend to personal obligations during certain memorable life events such as own wedding, labor, etc.

- Wedding Leave

Bigfoot grants five (5) days paid wedding leave to be availed within the date of the employee's wedding. The newlywed employee is required to submit a marriage certificate at most one (1) month after the wedding; otherwise, claimed leave shall be automatically deducted from one's salary. This must be filed at least one (1) month prior to the wedding date.

- Maternity Leave

Regardless of employment status, a pregnant employee, whether married or unmarried, is entitled to maternity leave of sixty (60) days in case of normal delivery, abortion or miscarriage, or seventy-eight (78) days in case of caesarian section delivery, with benefits equivalent to one hundred (100%) percent of the average daily salary credit of the employee as defined under the Social Security Law. This must be filed at least one (1) month prior to the due date.

- Paternity Leave (as per Republic Act No. 8187)

Bigfoot grants seven (7) days paid paternity leave to all married male employees, regardless of employment status, for the first four (4) deliveries of the employee's lawful wife, in order to allow the husband to lend support to his wife during her period of recovery and/or in the nursing of her newborn child. The employee may avail of the paternity leave before, during, or after the delivery. This request must be filed at least one (1) month prior to the due date and must be availed within the delivery date.

- Parental Leave for Solo Parents (as per Republic Act 8972)

Bigfoot grants seven (7) days paid parental leave to solo parents (as defined under RA 8972). A solo parent can only avail of the parental leave if he/she has rendered service of at least one (1) year with Bigfoot and is able to present a government-issued Solo Parent Identification card. This must be filed at least two (2) weeks prior to the date of the leave.

Bereavement Assistance

Bigfoot extends assistance and sympathy to an employee or an employee's immediate family member who has passed away.

Implementing Guidelines

- In case of death of an employee's immediate family member, the Company shall provide the following:

- Financial assistance in the amount of Three thousand pesos (Php 3,000.00)

- Mass card and/or flowers worth up to a maximum of One thousand pesos (Php 1,000.00)

- he employee is asked to file a Leave of Absence upon return for work under Emergency Leave. The employee must also submit the Death Certificate, upon which he/she is given a month to comply. The financial assistance given to the bereaved family shall be deducted from his salary in case the employee fails to submit the death certificate within thirty (30) working days from the death of the immediate family member.

- In case of death of an employee, the bereaved family shall be given financial assistance equivalent to one month of the employee's salary. The family shall also be provided with the pro-rated thirteenth (13th) month's pay, flowers worth up to a maximum of Three thousand pesos (Php 3,000.00) and a mass card worth up to a maximum of Five hundred pesos (Php 500.00). Unused Sick Leave and Vacation Leave credits will be converted to cash. All these shall be given to the employee's beneficiary on the day of the burial. Moreover, the employee shall be immediately released from all Company accountabilities.

Medical Health Insurance

Bigfoot provides a medical health insurance to probationary and regular employees, and one of the employees' eligible dependents as defined by the insurance Company. The coverage includes hospitalization, laboratory procedures/examinations, medical consultation services and outpatient services.Group Life Insurance

Bigfoot enrolls newly regularized employees to a group life insurance. Benefits include group yearly renewable term insurance, accidental death and disablement, and total and permanent disability income.Medical Services

Health Clinic

Bigfoot provides free medical consultation at the health clinic for all employees. Over-the-counter medicines are available at the clinic for mild ailments and for conditions needing immediate relief. These are given for initial dose only or as the need necessitates, provided that the employee has undergone thorough assessment by a medical professional. A Company nurse attends to medical- related needs or complaints during regular working days. A physician visits the clinic on scheduled days. Medical consultations with the physician shall be scheduled accordingly through the Company nurse.

In the absence of any medical personnel, an employee who needs immediate medical attention may directly go to the Human Resource office for assistance or to a nearby medical facility. For emergency situations within Company premises, trained first response personnel shall respond in addition to or in the absence of any medical personnel.

Medical Examination

As prescribed by law, all employees are required to undergo medical examinations provided by Bigfoot. These examinations are scheduled annually by the Human Resource Department. Failure to comply with the examination is considered an offense and is subject to proper disciplinary action.

From time to time, Bigfoot may schedule other medical examinations aside from the procedures in the annual medical examination as deemed necessary by the Company.

Athletic and Recreational Facilities

Bigfoot offers comfortable amenities such as athletic and recreational facilities to boost the morale and productivity of the employees.

Gym

Employees may use the gym before or after office hours. It is located at the second floor, beside the dance studio. It's open for all Bigfoot and IAFT staff from Mondays through Sundays, 06:00H to 24:00H.

Gym users are required to wear proper attire.

Employee Discounts and Privileges

Bigfoot employees can avail of exclusive discounts for the purchase of any Bigfoot merchandise.

Likewise, employees can enroll for free in selected

courses/workshops offered by the International Academy of Film and

Television, Inc. (IAFT). Immediate family members of Bigfoot employees can also avail of discounts in IAFT courses, as

determined by IAFT.

Employee Recognition Program

Bigfoot awards employees with exemplary attendance

records, work performance, and significant contributions to the

organization. Programs, criteria, and rewards may vary from time to

time.

Company Organizational Development Services

Sports and Recreation Program

Bigfoot organizes sports activities, Company or department outings, and other social activities for all employees scheduled all throughout the year if Company budget allows. In this connection, a recreation committee shall be organized to take the lead in planning, budgeting, and implementation.

Post Employment

Types of Separation

Voluntary Resignation

An employee who opts to sever his employment with the Company is required to submit one's resignation letter at least thirty (30) days prior to the last day of employment, as prescribed by law.

Resigning employee must accomplish a duly signed clearance form to be submitted to the Human Resource office on or before one's final working day with Bigfoot; therefore, employee must be cleared of all assets and accountabilities (e.g. workstation, Company ID, mobile phone, etc.) prior to the date of separation.

No separation pay is given to the resigned employee.

End of Contract

The length of service of a project-based employee or consultant is specified in the contract period and automatically terminates or ends after the contract period. No separation pay will be paid to the project-based employee or consultant, as there exists no employer-employee relationship between the company and the project- based employee or the consultant.

Termination

Bigfoot may dismiss an employee from work for a just or authorized cause and/or fpr violation of the Company policies, rules and regulations, after observing due process. Due process simply means an opportunity to be heard.

- Just Cause refers to any wrongdoing committed by an employee including but not limited to:

- Serious misconduct

- Willful disobedience of employers' lawful orders connected with work

- Gross and habitual neglect of duty

- Fraud or willful breach of trust

- Commission of crime or offense against the employer, employer's family member/s or representative

- Other analogous cases

Termination for just cause is also the final arbitration for disciplinary action.

- Authorized Cause refers to an economic circumstance not due to the employee's fault, including:

- The introduction of labor-saving devices

- Redundancy

- Retrenchment to prevent losses

- Closure or cessation of business

In authorized causes, due process means written notice of dismissal to the employee specifying the grounds, at least thirty (30) calendar days before the date of termination.

- Violation of Company, policies, rules and regulations.

- The inability of a probationary employee to meet the employer's prescribed standards of performance made known to him or her at the time of hiring is also a just cause for dismissal.

Exit and Clearance

Severance/Separation Pay

Severance/Separation pay is given to employees in instances covered by Articles 283 and 284 of the Labor Code of the Philippines. An employee's entitlement to separation pay depends on the reason or ground for the termination of one's services. An employee may be terminated for just cause or causes (i.e. gross and habitual neglect of duty, fraud or commission of a crime) under Article 282 of the Labor Code of the Philippines and will not be entitled to separation pay. If the termination is for authorized causes as enumerated under Article 283 of the Labor Code of the Philippines, the employee is entitled to a separation pay.

For voluntary resignation and termination due to authorized cause, the computation of separation pay of an employee shall be based on one's latest salary rate, and includes the pro-rated 13th month pay, tax refund (if applicable), and sick leave conversion (if applicable).

Retirement Pay

An employee may retire upon reaching the age of sixty (60) years or more but not beyond sixty-five (65) years old, which is hereby declared the compulsory retirement age, given that the employee has served at least five (5) years in the companyCompany and is entitled to retirement pay equivalent to at least one-half (1/2) month salary for every year of service, a fraction of at least six (6) months being considered as one whole year.

The term "one-half (1/2) month salary" shall mean fifteen (15) days plus one- twelfth (1/12) of the 13th month pay.

Exit Procedure [View PDF]

Salary Administration (General Labor Standards)

Salary

Observing six (6) workdays per week, employee monthly rate does not include payment for rest days (Sunday) but includes payment for ten (10) regular holidays and two (2) special days. With three hundred fourteen (314) workdays in a calendar year, Equivalent Daily Rate (EDR) shall be computed as follows:Overtime Work

Basic Monthly Rate X 12 = Equivalent Daily Rate

314Where:

302 = number of ordinary working days

10 = number of regular holidays

2 = number of special holidays

Employee will not be deducted for not working on these twelve (12) regular and special holidays.

An employee who works on any regular holiday, but not exceeding eight (8) hours, shall be paid two hundred (200%) percent of the employee's daily wage. If the holiday falls on a rest day, an employee who works on any regular holiday is entitled to an additional premium pay of at least thirty (30%) percent of the regular holiday pay of two hundred (200%) percent based on the employee's regular wage rate.

On the other hand, if employee performs work in excess of 8 hours on a regular holiday, employee shall be paid an additional 30%. The regular rest day rate of an employee shall consist of 200% of the employee's regular rate plus 30%.

Overtime work is work performed beyond eight (8) hours a day or according to the number of hours mutually agreed between employer and employee as the regular hours a day.Night Shift Differential

Computing Overtime:

On Ordinary Days

Number of hours in excess of 8 hours (125% x hourly rate)

On a rest day, special day or regular holiday

Number of hours in excess of 8 hours (130% x hourly rate)

An additional compensation of ten percent (10%) of an employee's regular wage shall be provided for each hour of work performed between 10:00PM and 6:00AM.Premium Pay

Computing Night Shift Premium Where Night Shift is a Regular Work:

On Ordinary day (110% x basic hourly rate)

On a rest day, special day, regular holiday (110% of regular hourly rate for a rest day, special day, regular holiday)

Computing Overtime on Night Shift:

On ordinary day (110%) x overtime hourly rate)

On rest day, special day or regular holiday (110% x overtime hourly rate for rest days, special days, regular holidays)

An additional compensation shall be provided for work performed within eight (8) hours on non-working days, such as rest days and special days.Rest Days and Holidays

Rest Day refers to any rest period of not less than twenty-four (24) consecutive hours after not more than six (6) consecutive work days. Holidays or Special Days refer to days classified as such by law or declared by competent public authority, whether or not it falls on an employee's work day or rest day.13th Month PayComputing pay for work done on:

- Regular Holidays

An employee is entitled to one's daily basic wage for any unworked regular holiday, provided concerned employee is present or is on leave of absence with pay on the work day immediately preceding the holiday.- Special Holidays

During special days, the principle of "no work, no pay" applies and on such other special days as may be proclaimed by the President or by the Congress.

A special day (130% x basic pay)

A special day, which is also a scheduled rest day (150% x basic pay)

A regular holiday (200% x basic pay)

A regular holiday, which is also a scheduled rest day (260% x basic pay)

All employers are required to pay their rank and file employees a thirteenth (13th) month pay, regardless of the nature of their employment and irrespective of the method by which their wages are paid provided they worked for at least one (1) month during a calendar year. Thirteenth (13th) month pay should be given to the employees not later than December 24 of every year. (See Computation of 13th Month Pay)

Computing 13th Month Pay:

Total basic salary earned for the year, exclusive of overtime premium, holiday pay, and night shift differential pay divided by 12 = 13th month pay.

Pay Procedures

Bigfoot observes electronic payment of salaries and enrolls the employee under an ATM payroll account. In the interim during processing of employee's ATM card, the Company may disburse the employee's pay in cash or check.

Bigfoot observes two payroll periods and pay dates - from the 24th of the month to the 8th of the next month accordingly released on the 15th; and on the 9th to 23rd of the month accordingly released on the 30th or last day of the same month. In the event that a payday falls on a holiday or a rest day, payday shall be scheduled on the next working day.

Timekeeping starts every cutoff period. During cutoff, printouts of each employee's daily attendance (login/logout) record are given to the relevant employees for review. These printouts are to be collected the following working day or immediately after employees have accepted and signed HR's copy of the printout. Valid changes in the attendance data are adjusted accordingly.

All government-mandated deductions and Company accountabilities (e.g. salary deduction schemes) are reflected on the pay slip.

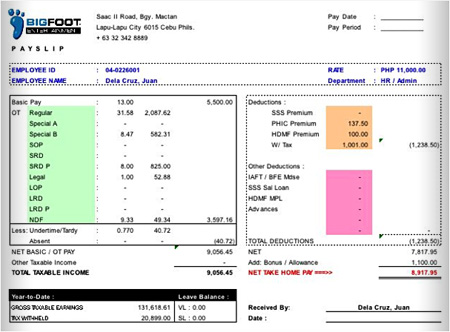

Pay Slip Format

Bigfoot observes two payroll periods and pay dates - from the 24th of the month to the 8th of the next month accordingly released on the 15th; and on the 9th to 23rd of the month accordingly released on the 30th or last day of the same month. In the event that a payday falls on a holiday or a rest day, payday shall be scheduled on the next working day.

Timekeeping starts every cutoff period. During cutoff, printouts of each employee's daily attendance (login/logout) record are given to the relevant employees for review. These printouts are to be collected the following working day or immediately after employees have accepted and signed HR's copy of the printout. Valid changes in the attendance data are adjusted accordingly.

All government-mandated deductions and Company accountabilities (e.g. salary deduction schemes) are reflected on the pay slip.

Pay Slip Format

Legend:

Basic pay - Basic pay/number of days worked

Regular - Regular Overtime

Special A - Special Overtime on weekdays

Special B - Special Overtime on rest day

SOP - Special Overtime Premium (excess of 8 hours)

SRD - Special Rest Day (special holiday falls on a day-off)

SRD P - Special Rest Day Premium (excess of 8 hours)

Legal - Overtime on Legal Holiday

LOP - Legal Overtime Premium (excess of 8 hours)

LRD - Legal Rest Day (regular holiday falls on day-off)

LRD P - Legal Rest Day Premium (excess of 8 hours)

NDF - Night Differential

Salary Adjustment

Depending on the financial capability of Bigfoot, salaries may be adjusted based on the annual performance review and/or the inflationary rate determined by the National Economic Development Authority (NEDA).

Group Incentive Plans and Bonuses

Aside from the 13th month pay, Bigfoot may award its employees bonuses or performance incentives, as approved by the Chief.

Business Expenses [View PDF]

Statutory Benefits

Social Security

Social security provides replacement income for workers and its beneficiaries in times of death, disability, sickness, child birth or miscarriage, and old age. The Social Security System (SSS) administers social security protection to workers in the private sector.

Monthly contributions are on average about 8.4% of monthly compensation if the worker is not earning over Php14,000.00, and slightly less if the worker is earning more. Roughly, the employer shoulders about 5.1%, and the employee 3.3%.

Hereunder are the benefits that are available for covered employees:

Sickness Benefit - A daily cash allowance (90% of the average salary credit) paid for the number of days a member is unable to work due to sickness or injury. A member can avail of this benefit if he/she is unable to work due to sickness or injury or is confined either in a hospital or at home for at least four (4) days, provided that the employee has paid at least three (3) months worth of contributions within the 12- month period immediately before the semester of sickness

- A member can be granted sickness benefit for a maximum of one hundred twenty (120) days in a calendar year

- It shall not be paid for more than two hundred forty (240) days on account of the same illness; it shall be considered for disability claim

Maternity Benefit - A daily cash allowance (100% of the average daily salary credit) granted to a female member who was unable to work due to childbirth or miscarriage; sixty (60) days for normal delivery or miscarriage and 78 days for caesarian section delivery

- Member must have paid at least three (3) monthly contributions within the twelve- month period immediately preceding the semester of her childbirth or miscarriage provided that she has given the required notification of her pregnancy through her employer

- It shall be paid only for the first 4 deliveries or miscarriages

Disability Benefit - This benefit is given to a member who becomes permanently disabled, either partially or totally, and can be paid either in monthly pension or lump sum

- A member who suffers partial or total permanent disability is qualified as a disability beneficiary if he has paid at least one monthly contribution to the SSS prior to the semester of his/her contingency

- Monthly Pension

- Refers to the cash benefit paid to a disabled member who has paid at least thirty-six (36) monthly contributions to the SSS prior to the semester of disability

- Lump Sum

- Amount is granted to those who have not paid the required thirty- six (36) monthly contributions

Retirement Benefit - A cash-in monthly pension or lump sum paid to members who can no longer work due to old age, available to a member who optionally retires at sixty (60) or to a member who is sixty (60) years old or over.

- Monthly Pension

- Lifetime cash benefit (until member dies) to the retiree who has paid at least one hundred twenty (120) monthly contributions

- Lump Sum

- Paid to those who have not paid the required one hundred twenty (120) monthly contributions

Death Benefit - A cash benefit in monthly pension or lump sum paid to the beneficiaries of a deceased member

Employee Compensation (EC) Program - Aims to assist workers who suffer work-connected sickness or injury resulting in disability or death

- Benefits under the EC program may be enjoyed simultaneously with benefits under the social security program

PhilHealth

The Philippine Health Insurance Corporation, or PhilHealth, is a government-owned corporation given the task to administer a sustainable program that will not only provide better health care services at an affordable cost, but also cover a broader membership base that will lead to universal coverage. The individual contribution depends on the salary range of the employee. - Benefits cover both hospitalization and outpatient care

- Hospitalization benefits can only be availed in PhilHealth accredited hospitals

- Member must have paid at least three (3) monthly contributions within the immediate 6 months period before the month of confinement

- PhilHealth assistance only covers the forty-five-day confinement allowed per year

PAG-IBIG Fund

PAG-IBIG is a compulsory deduction during payroll that offers loan programs.

An employee earning more than Php1,500 per month needs to contribute two (2%) percent of one's monthly salary. Likewise, the Company also provides a two (2%) percent counterpart every month. The maximum counterpart that an employee or employer is mandated to give is for a declared income of Php5,000 per month. However, employee can opt to declare more and pay more. - Housing Loan Program

- Multi-Purpose Loan

- Provident Savings Fund

Company Initiated Benefits

Meal Allowance

The Company provides employees with meal subsidy for rendered overtime work under specified time periods.

Implementing Guidelines

- All employees regardless of rank are given a meal allowance of one hundred pesos (Php 100.00) each provided that they have rendered overtime work for at least two (2) hours; and an additional one hundred and fifty pesos (Php 150) if rendered overtime work reaches six (6) hours.

- Generally, overtime work of those employees who have incurred tardiness on the same day are not entitled to meal allowance.

- In filing for request for meal allowance, employees are to fill-out the Overtime/Meal Allowance Form and submit the filled-out form to the HR Department not later than 5:00 PM of the covered date for overtime work.

- On the following day/schedule of reporting for work, the concerned

employees who have requested for meal allowance are to secure the

submitted Overtime/Meal Allowance Form from the HR Department for the

immediate supervisor's approval and give the form back to HR Department.

Transportation Allowance

The Company provides employees with a fixed monthly transportation allowance, and transportation subsidy from workplace to residence in the event of overtime work rendered until or after ten o'clock in the evening where options for transportation are limited.

Implementing Guidelines - Those hired or issued job offer as employees as of March 03, 2010 and onwards, shall no longer be offered a transportation allowance. However, incumbent (employees hired up to March 02, 2010) employees shall continue to be given an allowance of one thousand pesos (Php 1,000.00) for those belonging to job levels receiving basic monthly salaries below twenty thousand pesos (Php 20,000.00), and five hundred pesos (Php 500.00) for those receiving above Php 20,000.00.

- All employees regardless of rank who render official overtime work and logout on or after 10 o'clock in the evening shall be given taxicab fare subsidy of One hundred pesos (Php 100.00).

- Generally, employees who have incurred tardiness on the same day shall not be entitled to taxicab fare subsidy as they are not entitled to overtime pay (as applicable) and meal allowance.

- In filing for request for transportation fare subsidy, employees are to fill out the Overtime/Undertime/ Allowance Form duly approved by the department head concerned.

Vacation Leave

The Company provides regular employees with ten (10) days paid leave credits for workdays scheduled by employees to relieve oneself from the demands of work and spend quality time with oneself or others.

Upon employee's date of regularization, employee is granted a pro-rated number of vacation leave credits based on the month that an employee is regularized, as further shown in the table below:

MONTH OF REGULARIZATION

NO. OF LEAVE CREDITS

January

10 days

February

9.13 days

March

8.3 days

April

7.47 days

May

6.64 days

June

5.81 days

July

4.98 days

August

4.15 days

September

3.32 days

October

2.49 days

November

1.66 days

December

0.83 day

Implementing Guidelines

- Regular employees earn leave credits on a monthly basis based on the table below:

MONTH

LEAVE CREDITS

January

0.83 day

February

1.66 days

March

2.49 days

April

3.32 days

May

4.15 days

June

4.98 days

July

5.81 days

August

6.64 days

September

7.47 days

October

8.30 days

November

9.13 days

December

10.00 days

- Advance credits shall be allowed, such that at the beginning of the year, employees may use or avail of the full credit of ten (10) days vacation leave (and/or sick leave as the case may be) even though these are yet to be earned.

- However, in case of resignation or separation from the company, any difference from the number of leaves used or availed as against actual credits earned at the time of resignation or separation shall be recouped or deducted from the employee's final pay.

For example:

Employee X avails of five (5) vacation leave days in April 2009 then tenders resignation or is separated from the service on the same month. Based on the leave credits table, the employee's actual vacation leave credit for April is only 3.32 days. The difference of 1.68 days shall then be deducted from the employee's final pay.

- The same principle of proration (or pro-rate basis) shall apply in computing sick leave credits, which are convertible to cash when unused, in the event of resignation or separation from the company.

- No vacation leave shall be availed of unless the employee has filed for a leave of absence duly approved by the immediate superior. All approved vacation leaves should be submitted in hard copy at least one (1) week prior to the actual leave of absence to the HR Department. Employees who failed to file for a leave of absence shall be considered Absent Without Official Leave (AWOL) and will not be paid for his/her absence, without prejudice to whatever disciplinary action that may be taken against him/her in accordance with the company policies, rules and regulations and the Labor Code of the Philippines, as amended.

- An employee who goes on vacation leave is expected to report back to work on the following working day of the approved leave. If in case the employee cannot report back to work on the specified date, he is required to inform the HR Department/immediate superior at least on the first hour of the extended vacation leave. Upon return, he/she is required to file for a leave of absence for his extended Vacation Leave approved by his immediate superior to the Human Resource office. Failure to do so without notifying his immediate superior/HR shall be subjected to disciplinary action and will be considered absent.

- Leaves start at one (1) day and minutes thereafter. However, authorized undertime due to vacation may be credited to one's existing leave balance.

- Unused vacation leave credits are not convertible to cash, and are non-cumulative to the next set of vacation leave credits for the next calendar year.

- Employees with no remaining credits for vacation leave can still file for vacation leave but shall be treated as unpaid leave.

- Management reserves the right to disapprove vacation leaves and to recall any employee on leave, considering the critical operation needs of the Company.

Sick Leave

The Company provides regular employees with ten (10) days paid leave credits for workdays wherein reporting for work is impossible due to illness.

Implementing Guidelines - The Company grants ten (10) days sick leave with pay to regular employees upon start of every calendar year. Upon employee's date of regularization, employee is granted a pro-rated number of sick leave credits based on the month that an employee has been regularized, as further shown in the table below:

MONTH OF REGULARIZATION NO. OF LEAVE CREDITS January 10 days February 9.13 days March 8.3 days April 7.47 days May 6.64 days June 5.81 days July 4.98 days August 4.15 days September 3.32 days October 2.49 days November 1.66 days December 0.83 day

- If employee cannot report for work due to an unexpected illness, the employee is required to inform his/her (immediate) superior along with the HR Department at the first hour of that day by phone or sending relatives/friends who can personally report the reason for the absence. On the first hour for every day that an employee is absent, employee still has to inform his/her immediate superior or the HR Department except if the range of the sick leave has been specified, (i.e., doctor's recommendation). Upon reporting for work, the employee has to file an application for sick leave approved by the immediate superior to the HR Department. No sick leave shall be paid unless the employee has filed for a leave of absence. All sick leaves should be filed the day the employee returns back to work.

- In appropriate circumstances, the Company may require the employee to be examined by a Company-designated physician, at Company's expense.

- Whenever possible, and subject to the employee's health care provider's approval, absences for planned medical treatment should be scheduled in advance so as not to unduly disrupt Company operations.

- Employees shall be required to give at least one (1) week advance notice in the event of a foreseeable medical treatment. To assist in arranging the work assignments during employee's absence, employee must give prior notice as well as an indication, to the extent known, of the expected return date.

- In the event that an employee has been absent from work for three (3) consecutive days, the employee is required to present a medical certification that he/she was sick for the period and that he/she is already physically and mentally fit to return to work (a "fitness-for-duty" report) to the Human Resource office. Where such a certification is required, the employee will bear the cost of the certification and is not entitled to be paid for the time or travel costs spent in acquiring the certification.

- Leaves begin at one (1) day and minutes thereafter. However, authorized undertime due to sickness may be credited to one's existing leave balance.

- Unused sick leave credits at the end of the calendar year are convertible to cash and will be credited to the employee's account on the first payroll after the start of the next calendar year.

- Employees with no remaining credits for sick leave can still file for sick leave but shall be treated as unpaid leave.

- Management reserves the right to disapprove any sick leave, if in its opinion, the employee is not really sick and the operations of the Company will be unduly jeopardized. However, if the Company designated physician declares that the employee is actually sick and needs rest, management will grant the sick leave.

Emergency Leave

Bigfoot provides employees with paid leave credits to supplement consumed vacation or sick leave credits during emergency situations wherein the employee's immediate attention is required.

Implementing Guidelines

- All regular employees are given three (3) Emergency Leave credits, in addition to the employee's vacation and sick leave credits, which is not cumulative and not convertible to cash.

- An "emergency" is defined as an unexpected circumstance, such as fire, earthquake, typhoon, landslides, death or serious illness of an immediate family member, and/or any other extenuating circumstances that affects the employee and his family and causes the employee to be absent from work.

- The emergency leave must be filed on the day that the employee has returned to report for work duly approved by the department superior and the HR Department. Otherwise, it shall be considered as leave without pay.

- Leaves start at one (1) day and minutes thereafter. However, authorized undertime due to emergency may be credited to one's existing leave balance.

An "immediate family member" is defined as a parent, parent-in-law, spouse, children, or sibling.

Special Leaves

Bigfoot provides ample time for employees to attend to personal obligations during certain memorable life events such as own wedding, labor, etc.

- Wedding Leave

Bigfoot grants five (5) days paid wedding leave to be availed within the date of the employee's wedding. The newlywed employee is required to submit a marriage certificate at most one (1) month after the wedding; otherwise, claimed leave shall be automatically deducted from one's salary. This must be filed at least one (1) month prior to the wedding date.

- Maternity Leave

Regardless of employment status, a pregnant employee, whether married or unmarried, is entitled to maternity leave of sixty (60) days in case of normal delivery, abortion or miscarriage, or seventy-eight (78) days in case of caesarian section delivery, with benefits equivalent to one hundred (100%) percent of the average daily salary credit of the employee as defined under the Social Security Law. This must be filed at least one (1) month prior to the due date.

- Paternity Leave (as per Republic Act No. 8187)

Bigfoot grants seven (7) days paid paternity leave to all married male employees, regardless of employment status, for the first four (4) deliveries of the employee's lawful wife, in order to allow the husband to lend support to his wife during her period of recovery and/or in the nursing of her newborn child. The employee may avail of the paternity leave before, during, or after the delivery. This request must be filed at least one (1) month prior to the due date and must be availed within the delivery date.

- Parental Leave for Solo Parents (as per Republic Act 8972)

Bigfoot grants seven (7) days paid parental leave to solo parents (as defined under RA 8972). A solo parent can only avail of the parental leave if he/she has rendered service of at least one (1) year with Bigfoot and is able to present a government-issued Solo Parent Identification card. This must be filed at least two (2) weeks prior to the date of the leave.

Bereavement Assistance

Bigfoot extends assistance and sympathy to an employee or an employee's immediate family member who has passed away.

Implementing Guidelines

- In case of death of an employee's immediate family member, the Company shall provide the following:

- Financial assistance in the amount of Three thousand pesos (Php 3,000.00)

- Mass card and/or flowers worth up to a maximum of One thousand pesos (Php 1,000.00)

- he employee is asked to file a Leave of Absence upon return for work under Emergency Leave. The employee must also submit the Death Certificate, upon which he/she is given a month to comply. The financial assistance given to the bereaved family shall be deducted from his salary in case the employee fails to submit the death certificate within thirty (30) working days from the death of the immediate family member.

- In case of death of an employee, the bereaved family shall be given financial assistance equivalent to one month of the employee's salary. The family shall also be provided with the pro-rated thirteenth (13th) month's pay, flowers worth up to a maximum of Three thousand pesos (Php 3,000.00) and a mass card worth up to a maximum of Five hundred pesos (Php 500.00). Unused Sick Leave and Vacation Leave credits will be converted to cash. All these shall be given to the employee's beneficiary on the day of the burial. Moreover, the employee shall be immediately released from all Company accountabilities.

Medical Health Insurance

Bigfoot provides a medical health insurance to probationary and regular employees, and one of the employees' eligible dependents as defined by the insurance Company. The coverage includes hospitalization, laboratory procedures/examinations, medical consultation services and outpatient services.Group Life Insurance

Bigfoot enrolls newly regularized employees to a group life insurance. Benefits include group yearly renewable term insurance, accidental death and disablement, and total and permanent disability income.Medical Services

Health Clinic

Bigfoot provides free medical consultation at the health clinic for all employees. Over-the-counter medicines are available at the clinic for mild ailments and for conditions needing immediate relief. These are given for initial dose only or as the need necessitates, provided that the employee has undergone thorough assessment by a medical professional. A Company nurse attends to medical- related needs or complaints during regular working days. A physician visits the clinic on scheduled days. Medical consultations with the physician shall be scheduled accordingly through the Company nurse.

In the absence of any medical personnel, an employee who needs immediate medical attention may directly go to the Human Resource office for assistance or to a nearby medical facility. For emergency situations within Company premises, trained first response personnel shall respond in addition to or in the absence of any medical personnel.

Medical Examination

As prescribed by law, all employees are required to undergo medical examinations provided by Bigfoot. These examinations are scheduled annually by the Human Resource Department. Failure to comply with the examination is considered an offense and is subject to proper disciplinary action.

From time to time, Bigfoot may schedule other medical examinations aside from the procedures in the annual medical examination as deemed necessary by the Company.

Athletic and Recreational Facilities

Bigfoot offers comfortable amenities such as athletic and recreational facilities to boost the morale and productivity of the employees.

Gym

Employees may use the gym before or after office hours. It is located at the second floor, beside the dance studio. It's open for all Bigfoot and IAFT staff from Mondays through Sundays, 06:00H to 24:00H.

Gym users are required to wear proper attire.

Employee Discounts and Privileges

Bigfoot employees can avail of exclusive discounts for the purchase of any Bigfoot merchandise.

Likewise, employees can enroll for free in selected

courses/workshops offered by the International Academy of Film and

Television, Inc. (IAFT). Immediate family members of Bigfoot employees can also avail of discounts in IAFT courses, as

determined by IAFT.

Employee Recognition Program

Bigfoot awards employees with exemplary attendance

records, work performance, and significant contributions to the

organization. Programs, criteria, and rewards may vary from time to

time.

Company Organizational Development Services

Sports and Recreation Program

Bigfoot organizes sports activities, Company or department outings, and other social activities for all employees scheduled all throughout the year if Company budget allows. In this connection, a recreation committee shall be organized to take the lead in planning, budgeting, and implementation.

Post Employment

Types of Separation

Voluntary Resignation

An employee who opts to sever his employment with the Company is required to submit one's resignation letter at least thirty (30) days prior to the last day of employment, as prescribed by law.

Resigning employee must accomplish a duly signed clearance form to be submitted to the Human Resource office on or before one's final working day with Bigfoot; therefore, employee must be cleared of all assets and accountabilities (e.g. workstation, Company ID, mobile phone, etc.) prior to the date of separation.

No separation pay is given to the resigned employee.

End of Contract

The length of service of a project-based employee or consultant is specified in the contract period and automatically terminates or ends after the contract period. No separation pay will be paid to the project-based employee or consultant, as there exists no employer-employee relationship between the company and the project- based employee or the consultant.

Termination

Bigfoot may dismiss an employee from work for a just or authorized cause and/or fpr violation of the Company policies, rules and regulations, after observing due process. Due process simply means an opportunity to be heard.

- Just Cause refers to any wrongdoing committed by an employee including but not limited to:

- Serious misconduct

- Willful disobedience of employers' lawful orders connected with work

- Gross and habitual neglect of duty

- Fraud or willful breach of trust

- Commission of crime or offense against the employer, employer's family member/s or representative

- Other analogous cases

Termination for just cause is also the final arbitration for disciplinary action.

- Authorized Cause refers to an economic circumstance not due to the employee's fault, including:

- The introduction of labor-saving devices

- Redundancy

- Retrenchment to prevent losses

- Closure or cessation of business

In authorized causes, due process means written notice of dismissal to the employee specifying the grounds, at least thirty (30) calendar days before the date of termination.

- Violation of Company, policies, rules and regulations.

- The inability of a probationary employee to meet the employer's prescribed standards of performance made known to him or her at the time of hiring is also a just cause for dismissal.

Exit and Clearance

Severance/Separation Pay

Severance/Separation pay is given to employees in instances covered by Articles 283 and 284 of the Labor Code of the Philippines. An employee's entitlement to separation pay depends on the reason or ground for the termination of one's services. An employee may be terminated for just cause or causes (i.e. gross and habitual neglect of duty, fraud or commission of a crime) under Article 282 of the Labor Code of the Philippines and will not be entitled to separation pay. If the termination is for authorized causes as enumerated under Article 283 of the Labor Code of the Philippines, the employee is entitled to a separation pay.

For voluntary resignation and termination due to authorized cause, the computation of separation pay of an employee shall be based on one's latest salary rate, and includes the pro-rated 13th month pay, tax refund (if applicable), and sick leave conversion (if applicable).